When Jimmy Buffett sang about changes in latitudes and attitudes, he probably never imagined that his $275 million legacy would become the center of a bitter legal storm that’s anything but the laid-back paradise he spent decades celebrating. The man who built an empire on the simple philosophy of “it’s five o’clock somewhere” has left behind a complex web of financial disputes that would make even the most seasoned Parrothead reach for something stronger than a margarita.

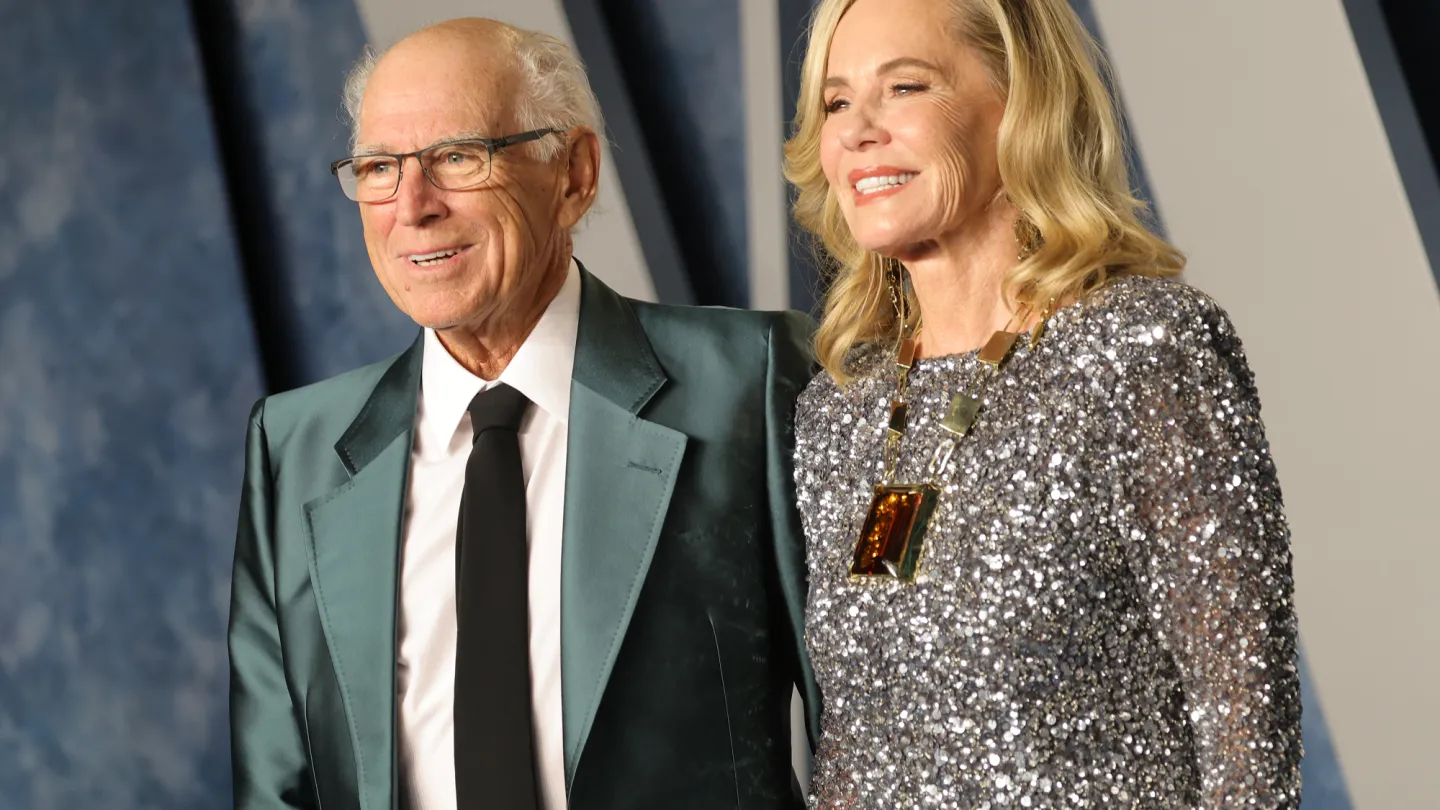

The legal battle unfolding in courtrooms from Los Angeles to Florida reads like a cautionary tale about what happens when trust breaks down—literally and figuratively—in the management of enormous wealth. At its center are two key figures: Jane Buffett, the singer’s widow trying to secure her financial future, and Rick Mozenter, the co-trustee whose management decisions have sparked what Jane describes as an “unsolvable rift.”

When Paradise Becomes a Problem

The numbers alone tell a sobering story. With $275 million in assets, Jane Buffett is being told to expect roughly $2 million annually—a return rate of less than one percent that would make any financial advisor wince. To put this in perspective, a conservative investment strategy typically yields 4-6% annually, meaning the trust should theoretically generate $11-16 million per year, not the meager $2 million being projected.

Even more troubling, according to Jane’s lawsuit filed in Los Angeles Superior Court, Mozenter suggested she “consider adjustments” to her lifestyle or sell her own personal assets to make up for the shortfall. For a woman whose husband built a billion-dollar brand around the concept of living well and enjoying life’s pleasures, being told to downsize feels like a betrayal of everything Jimmy Buffett represented.

The situation becomes even more perplexing when you consider that Margaritaville—the sprawling hospitality empire partially owned by the trust—has been anything but struggling. The company paid out roughly $14 million over an 18-month period, yet Mozenter allegedly refused to factor future distributions from this goldmine into his conservative income projections.

The Empire Jimmy Built

To understand the stakes involved, it’s worth remembering how Jimmy Buffett transformed himself from a struggling country singer into a lifestyle mogul. After finding his musical footing in the early 1970s with his first record contract, Buffett didn’t just create hit songs—he created an entire philosophy. That sixth album, featuring the iconic “Margaritaville,” wasn’t just a collection of tracks; it was the foundation for a business empire that would eventually span restaurants, hotels, merchandise, and experiences.

Buffett understood something that many artists miss: he wasn’t just selling music, he was selling an escape. Every Margaritaville restaurant, every piece of branded merchandise, every concert was an invitation to step away from the everyday grind and embrace a more relaxed way of living. The fact that this empire continues to generate millions in revenue makes the trust’s conservative income projections all the more baffling.

A Year of Stonewalling

Perhaps most frustrating for Jane Buffett has been the communication breakdown with Mozenter. According to the lawsuit, when she asked about her expected income just a month after Jimmy’s death in 2023, she was allegedly stonewalled for over a year. Think about that—a grieving widow asking basic questions about her financial security and being met with silence from the person legally obligated to protect her interests.

When information finally came, it arrived with conditions and criticisms that seemed to add insult to injury. Jane was pushed to approve Jeffrey Smith as counsel for co-trustees, only to have Smith later accuse her of breaching her fiduciary duty for suggesting the trust work with Irving Azoff, Jimmy’s longtime music manager, on a documentary project. The irony is palpable—being accused of poor judgment for wanting to work with someone who helped build Jimmy’s career.

The breaking point came when Mozenter’s firm sent Jane voluminous tax return drafts and demanded comments within three days. For someone already frustrated by months of poor communication, this rushed timeline likely felt like another example of being marginalized in decisions about her own financial future.

Properties in Paradise Lost

Beyond the income disputes, there’s also the matter of real estate that adds another layer of complexity to this battle. Jane’s petition alleges that Mozenter transferred properties in New York, Florida, and St. Barthélemy island to the estate when they should have been left to her personally. These aren’t just financial assets—they’re likely homes filled with memories, places where Jimmy wrote songs, entertained friends, and lived the lifestyle he celebrated in his music.

The fight over these properties represents more than just dollars and cents. They’re tangible connections to a life shared, and their disputed ownership adds emotional weight to what’s already a financially devastating situation.

The Cost of Trust Management

Adding another troubling dimension to this story is the revelation that Mozenter’s firm collects $1.7 million annually to oversee the trust. When you’re paying nearly as much in management fees as the beneficiary receives in income, something is fundamentally wrong with the equation. Jane’s lawsuit poses a stark question: Mozenter is “either not competent to administer the trust or unwilling to act in Mrs. Buffett’s best interests.”

This isn’t just about money—it’s about competence and responsibility. When you’re entrusted with preserving and growing a legacy worth hundreds of millions of dollars, generating less than a 1% return while collecting substantial fees raises serious questions about priorities and capabilities.

Dueling Courtrooms

The battle has now expanded to multiple jurisdictions, with Jane filing in California while Mozenter has countered with his own petition in Florida seeking to remove her as co-trustee and personal representative. This geographic split adds complexity and cost to an already contentious situation, ensuring that lawyers in multiple states will profit while the dispute drags on.

The Bigger Picture

This legal battle represents more than just a family dispute—it’s a cautionary tale about estate planning, trust management, and the importance of clear communication in handling significant wealth. Jimmy Buffett spent his career celebrating the simple pleasures of life, but his death has unleashed complications that are anything but simple.

For fans who grew up with Buffett’s music as the soundtrack to good times and relaxed living, this legal battle serves as a sobering reminder that even in paradise, money can create problems that no amount of laid-back philosophy can solve. The man who taught us that it’s five o’clock somewhere has left behind a situation where, unfortunately, it’s always time for lawyers.

As this case moves through the courts, it will likely serve as a case study in trust management and the importance of choosing trustees who truly understand their fiduciary responsibilities. Jane Buffett isn’t just fighting for her financial security—she’s fighting to preserve the legacy of a man who believed life should be about more than just surviving, but about thriving in your own version of paradise.